Energy Star – 45L Tax Credits for Zero Energy Ready Homes

7322 TouchStone St, Houston, TX 77028

45L Tax Credits for Zero Energy Ready Homes

Disclaimer: (Energy Star) This webpage provides an overview of the DOE Zero Energy Ready Home program and how it relates to the New Energy Efficient Home Tax Credit found in section 45L of the Internal Revenue Code. The information provided here does not constitute professional tax advice or other professional financial guidance. It should not be used as the only source of information when making decisions regarding design, purchasing, investments, or the tax implications of new home construction, or when executing other binding agreements. In the event that there is conflict between information provided on this webpage and guidance or notices published by IRS, the information published by IRS shall take precedence

The Updated Section 45L

The Inflation Reduction Act of 2022 (IRA) amended Internal Revenue Code Section 45L to provide taxpayers with a tax credit for eligible new or substantially reconstructed homes that meet applicable ENERGY STAR home program or DOE Zero Energy Ready Home (ZERH) program requirements. The new 45L provisions include two tiers of credits, with the higher credits for eligible homes and dwelling units certified to applicable ZERH program requirements. The 45L credit is $5,000 for single family and manufactured homes eligible to participate in the EPA’s ENERGY STAR Residential New Construction Program or the ENERGY STAR Manufactured New Homes Program, respectively, and which are certified to applicable ZERH program requirements. The 45L credit is $1,000 for dwelling units that are part of a building eligible to participate in the ENERGY STAR Multifamily New Construction Program, and which are certified to applicable ZERH program requirements, unless the project meets prevailing wage requirements, in which case the 45L credit is $5,000 per dwelling unit. These new 45L rules apply to qualified energy efficient homes acquired after December 31, 2022, and before January 1, 2033, for use as a residence during the taxable year. DOE continues to coordinate with the Internal Revenue Service (IRS) regarding forthcoming IRS 45L guidance.

DOE Zero Energy Ready Home (ZERH) Program Applicability for 45L Tax Credit, by Calendar Year

ZERH program requirements vary by housing sector. To improve the usability of the program requirements and the certification process for different sectors, DOE is developing and maintaining program requirements documents for each major housing sector. DOE anticipates updating these documents over the coming years, with new editions of the requirements referred to as versions.

The three housing sector tables below indicate DOE’s anticipated version release schedule for the ZERH program. The certification requirements for each housing sector are included below with links to detailed requirements documents (PDF) for each program version. IRS guidance will establish when a dwelling unit needs to be certified to the version in effect for that housing sector as listed below to qualify for the ZERH provisions of 45L tax credit. The tables list all current and planned versions through 2025, by Calendar Year (January 1-December 31). In conjunction with IRS, DOE will provide additional information on any planned ZERH program changes beyond 2025 on future dates to be determined. Note, for certain future planned versions the requirements documents are still under development.

https://www.energy.gov/eere/buildings/45l-tax-credits-zero-energy-ready-homes

Energy Star – 45L Tax Credits for Zero Energy Ready Homes

1117 Phyllis St, Deer Park, TX 77536

45L Tax Credits for Zero Energy Ready Homes

Disclaimer: (Energy Star) This webpage provides an overview of the DOE Zero Energy Ready Home program and how it relates to the New Energy Efficient Home Tax Credit found in section 45L of the Internal Revenue Code. The information provided here does not constitute professional tax advice or other professional financial guidance. It should not be used as the only source of information when making decisions regarding design, purchasing, investments, or the tax implications of new home construction, or when executing other binding agreements. In the event that there is conflict between information provided on this webpage and guidance or notices published by IRS, the information published by IRS shall take precedence

The Updated Section 45L

The Inflation Reduction Act of 2022 (IRA) amended Internal Revenue Code Section 45L to provide taxpayers with a tax credit for eligible new or substantially reconstructed homes that meet applicable ENERGY STAR home program or DOE Zero Energy Ready Home (ZERH) program requirements. The new 45L provisions include two tiers of credits, with the higher credits for eligible homes and dwelling units certified to applicable ZERH program requirements. The 45L credit is $5,000 for single family and manufactured homes eligible to participate in the EPA’s ENERGY STAR Residential New Construction Program or the ENERGY STAR Manufactured New Homes Program, respectively, and which are certified to applicable ZERH program requirements. The 45L credit is $1,000 for dwelling units that are part of a building eligible to participate in the ENERGY STAR Multifamily New Construction Program, and which are certified to applicable ZERH program requirements, unless the project meets prevailing wage requirements, in which case the 45L credit is $5,000 per dwelling unit. These new 45L rules apply to qualified energy efficient homes acquired after December 31, 2022, and before January 1, 2033, for use as a residence during the taxable year. DOE continues to coordinate with the Internal Revenue Service (IRS) regarding forthcoming IRS 45L guidance.

DOE Zero Energy Ready Home (ZERH) Program Applicability for 45L Tax Credit, by Calendar Year

ZERH program requirements vary by housing sector. To improve the usability of the program requirements and the certification process for different sectors, DOE is developing and maintaining program requirements documents for each major housing sector. DOE anticipates updating these documents over the coming years, with new editions of the requirements referred to as versions.

The three housing sector tables below indicate DOE’s anticipated version release schedule for the ZERH program. The certification requirements for each housing sector are included below with links to detailed requirements documents (PDF) for each program version. IRS guidance will establish when a dwelling unit needs to be certified to the version in effect for that housing sector as listed below to qualify for the ZERH provisions of 45L tax credit. The tables list all current and planned versions through 2025, by Calendar Year (January 1-December 31). In conjunction with IRS, DOE will provide additional information on any planned ZERH program changes beyond 2025 on future dates to be determined. Note, for certain future planned versions the requirements documents are still under development.

https://www.energy.gov/eere/buildings/45l-tax-credits-zero-energy-ready-homes

Minimizing Energy Losses in Ducts at 2406 Truxillo St, Houston TX 77004

2406 Truxillo St, Houston TX 77004

Minimizing Energy Losses in Ducts

Minimizing energy losses in ducts by seeing if the ducts are poorly sealed or insulated. That could tell you why your energy bill in high. Your air ducts are one of the most important systems in your home, and if the ducts are poorly sealed or insulated, they are likely contributing to higher energy bills.

Your home’s duct system is a branching network of tubes in the walls, floors, and ceilings; it carries the air from your home’s furnace and central air conditioner to each room. Ducts are made of sheet metal, fiberglass, or other materials.

Ducts that leak heated air into unheated spaces can add hundreds of dollars a year to your heating and cooling bills, but you can reduce that loss by sealing and insulating your ducts. Insulating ducts in unconditioned spaces is usually very cost-effective. Existing ducts may also be blocked or may require simple upgrades.

Designing and Installing New Duct Systems

In new home construction or in retrofits, proper duct system design is critical. In recent years, energy-saving designs have sought to include ducts and heating systems in the conditioned space.

Efficient and well-designed duct systems distribute air properly throughout your home without leaking to keep all rooms at a comfortable temperature. The system should provide balanced supply and return flow to maintain a neutral pressure within the house.

Even well sealed and insulated ducts will leak and lose some heat, so many new energy-efficient homes place the duct system within the conditioned space of the home. The simplest way to accomplish this is to hide the ducts in dropped ceilings and in corners of rooms. Ducts can also be located in a sealed and insulated chase extending into the attic or built into raised floors. In both of these latter cases, care must be taken during construction to prevent contractors from using the duct chases for wiring or other utilities.

In either case, actual ducts must be used — chases and floor cavities should not be used as ducts. Regardless of where they are installed, ducts should be well sealed. Although ducts can be configured in a number of ways, the “trunk and branch” and “radial” supply duct configurations are most suitable for ducts located in conditioned spaces.

Air return duct systems can be configured in two ways: each room can have a return duct that sends air back to the heating and cooling equipment or return grills can be located in central locations on each floor. For the latter case, either grills must be installed to allow air to pass out of closed rooms, or short “jumper ducts” can be installed to connect the vent in one room with the next, allowing air to flow back to the central return grilles. Door undercuts help, but they are usually not sufficient for return airflow.

You can perform a simple check for adequate return air capacity by doing the following:

- Close all exterior doors and windows

- Close all interior room doors

- Turn on the central air handler

- “Crack” interior doors one by one and observe if the door closes or further opens “on its own.” (Whether it closes or opens will depend on the direction of the air handler-driven air flow.) Rooms served by air-moved doors have restricted return air flow and need pressure relief as described above.

Maintaining and Upgrading Existing Duct Systems

Sealing your ducts to prevent leaks is even more important if the ducts are located in an unconditioned area such as an attic or vented crawlspace. If the supply ducts are leaking, heated or cooled air can be forced out of unsealed joints and lost. In addition, unconditioned air can be drawn into return ducts through unsealed joints.

Although minor duct repairs are easy to make, qualified professionals should seal and insulate ducts in unconditioned spaces to ensure the use of appropriate sealing materials.

Aside from sealing your ducts, the simplest and most effective means of maintaining your air distribution system is to ensure that furniture and other objects are not blocking the airflow through your registers, and to vacuum the registers to remove any dust buildup.

Existing duct systems often suffer from design deficiencies in the return air system, and modifications by the homeowner (or just a tendency to keep doors closed) may contribute to these problems. Any rooms with a lack of sufficient return airflow may benefit from relatively simple upgrades, such as the installation of new return-air grilles, undercutting doors for return air, or installing a jumper duct.

Some rooms may also be hard to heat and cool because of inadequate supply ducts or grilles. If this is the case, you should first examine whether the problem is the room itself: fix any problems with insulation, air leakage, or inefficient windows first. If the problem persists, you may be able to increase the size of the supply duct or add an additional duct to provide the needed airflow to the room.

Minor Duct Repair Tips for Minimizing Energy Losses in Ducts

- Check your ducts for air leaks. First, look for sections that should be joined but have separated and then look for obvious holes.

- Duct mastic is the preferred material for sealing ductwork seams and joints. It is more durable than any available tape and generally easier for a do-it-yourself installation. Its only drawback is that it will not bridge gaps over ¼ inch. Such gaps must be first bridged with web-type drywall tape, or a good quality heat approved tape.

- If you use tape to seal your ducts, avoid cloth-backed, rubber adhesive duct tape — it tends to fail quickly. Instead, use mastic, butyl tape, foil tape, or other heat-approved tapes. Look for tape with the Underwriters Laboratories (UL) logo.

- Remember that insulating ducts in the basement will make the basement colder. If both the ducts and the basement walls are not insulated, consider insulating both. Water pipes and drains in unconditioned spaces could freeze and burst if the heat ducts are fully insulated because there would be no heat source to prevent the space from freezing in cold weather. However, using an electric heating tape wrap on the pipes can prevent this. Check with a professional contractor.

- Hire a professional to install both supply and return registers in the basement rooms after converting your basement to a living area.

- Be sure a well-sealed vapor barrier exists on the outside of the insulation on cooling ducts to prevent moisture condensation.

- If you have a fuel-burning furnace, stove, or other appliance or an attached garage, install a carbon monoxide (CO) monitor to alert you to harmful CO levels.

- Be sure to get professional help when doing ductwork. A qualified professional should always perform changes and repairs to a duct system.

2706 Sledge St, Houston, TX 77009 – Minimizing Energy Losses in Ducts

2706 Sledge St, Houston, TX 77009

Minimizing Energy Losses in Ducts

Minimizing energy losses in ducts is an important aspect of energy efficiency in HVAC (Heating, Ventilation, and Air Conditioning) systems. Ducts are used to distribute conditioned air throughout a building, and any energy losses during the distribution process can lead to increased energy consumption and reduced system performance. Here are some key measures to minimize energy losses in ducts:

1. Proper Duct Design: Ensure that ductwork is properly designed to minimize pressure losses. Use appropriately sized ducts, minimize the number of bends and transitions, and maintain a balanced airflow distribution. Consult industry guidelines or work with an HVAC professional to design an efficient duct system.

2. Sealing: Duct leakage is a major source of energy losses. Seal all joints, connections, and seams in the ductwork using approved sealing materials such as mastic or metal tape. Pay particular attention to connections at registers, grilles, and air-handling units.

3. Insulation: Insulate ducts that run through unconditioned spaces, such as attics, crawlspaces, or basements. Insulation helps to prevent heat transfer between the ductwork and the surrounding environment, reducing energy losses and improving system efficiency.

4. Duct Material: Consider using insulated ducts with low thermal conductivity. Insulated ducts minimize heat transfer through the duct walls, helping to maintain the desired temperature of the conditioned air as it travels through the system.

5. Avoiding Overlong Duct Runs: Minimize the length of duct runs as much as possible. Longer ducts result in increased friction losses, which can reduce airflow and energy efficiency. Optimize the layout and location of HVAC equipment to keep duct runs as short and direct as feasible.

6. Balancing and Adjusting Dampers: Balancing the airflow within the duct system ensures that each room receives the appropriate amount of conditioned air. Adjust dampers at branch points and in individual ducts to balance the airflow and avoid over-pressurizing or under-pressurizing certain areas.

7. Regular Maintenance: Conduct regular inspections of the ductwork to check for leaks, obstructions, or damage. Clean the ducts periodically to remove dust, debris, or any substances that could impede airflow.

8. Air Filters: Install high-quality air filters and regularly replace them according to the manufacturer’s recommendations. Clean air filters help maintain optimal airflow, reducing pressure drops and energy losses.

By implementing these measures, you can significantly minimize energy losses in ducts, improve the overall efficiency of your HVAC system, and reduce energy consumption. Consulting with a professional HVAC contractor or engineer can provide valuable insights specific to your building’s requirements and help optimize energy efficiency.

https://homereadyinspections.com/builders-hvac/

20804 Opal St, Prairie View, TX 77484 – Minimizing Energy Losses in Ducts

20804 Opal St, Prairie View, TX 77484

Minimizing Energy Losses in Ducts

Minimizing energy losses in ducts is an important aspect of energy efficiency in HVAC (Heating, Ventilation, and Air Conditioning) systems. Ducts are used to distribute conditioned air throughout a building, and any energy losses during the distribution process can lead to increased energy consumption and reduced system performance. Here are some key measures to minimize energy losses in ducts:

1. Proper Duct Design: Ensure that ductwork is properly designed to minimize pressure losses. Use appropriately sized ducts, minimize the number of bends and transitions, and maintain a balanced airflow distribution. Consult industry guidelines or work with an HVAC professional to design an efficient duct system.

2. Sealing: Duct leakage is a major source of energy losses. Seal all joints, connections, and seams in the ductwork using approved sealing materials such as mastic or metal tape. Pay particular attention to connections at registers, grilles, and air-handling units.

3. Insulation: Insulate ducts that run through unconditioned spaces, such as attics, crawlspaces, or basements. Insulation helps to prevent heat transfer between the ductwork and the surrounding environment, reducing energy losses and improving system efficiency.

4. Duct Material: Consider using insulated ducts with low thermal conductivity. Insulated ducts minimize heat transfer through the duct walls, helping to maintain the desired temperature of the conditioned air as it travels through the system.

5. Avoiding Overlong Duct Runs: Minimize the length of duct runs as much as possible. Longer ducts result in increased friction losses, which can reduce airflow and energy efficiency. Optimize the layout and location of HVAC equipment to keep duct runs as short and direct as feasible.

6. Balancing and Adjusting Dampers: Balancing the airflow within the duct system ensures that each room receives the appropriate amount of conditioned air. Adjust dampers at branch points and in individual ducts to balance the airflow and avoid over-pressurizing or under-pressurizing certain areas.

7. Regular Maintenance: Conduct regular inspections of the ductwork to check for leaks, obstructions, or damage. Clean the ducts periodically to remove dust, debris, or any substances that could impede airflow.

8. Air Filters: Install high-quality air filters and regularly replace them according to the manufacturer’s recommendations. Clean air filters help maintain optimal airflow, reducing pressure drops and energy losses.

By implementing these measures, you can significantly minimize energy losses in ducts, improve the overall efficiency of your HVAC system, and reduce energy consumption. Consulting with a professional HVAC contractor or engineer can provide valuable insights specific to your building’s requirements and help optimize energy efficiency.

https://homereadyinspections.com/builders-hvac/

6552 Calder St, Houston, TX 77007 – Minimizing Energy Losses in Ducts

6552 Calder St, Houston, TX 77007

Minimizing Energy Losses in Ducts

Minimizing energy losses in ducts is an important aspect of energy efficiency in HVAC (Heating, Ventilation, and Air Conditioning) systems. Ducts are used to distribute conditioned air throughout a building, and any energy losses during the distribution process can lead to increased energy consumption and reduced system performance. Here are some key measures to minimize energy losses in ducts:

1. Proper Duct Design: Ensure that ductwork is properly designed to minimize pressure losses. Use appropriately sized ducts, minimize the number of bends and transitions, and maintain a balanced airflow distribution. Consult industry guidelines or work with an HVAC professional to design an efficient duct system.

2. Sealing: Duct leakage is a major source of energy losses. Seal all joints, connections, and seams in the ductwork using approved sealing materials such as mastic or metal tape. Pay particular attention to connections at registers, grilles, and air-handling units.

3. Insulation: Insulate ducts that run through unconditioned spaces, such as attics, crawlspaces, or basements. Insulation helps to prevent heat transfer between the ductwork and the surrounding environment, reducing energy losses and improving system efficiency.

4. Duct Material: Consider using insulated ducts with low thermal conductivity. Insulated ducts minimize heat transfer through the duct walls, helping to maintain the desired temperature of the conditioned air as it travels through the system.

5. Avoiding Overlong Duct Runs: Minimize the length of duct runs as much as possible. Longer ducts result in increased friction losses, which can reduce airflow and energy efficiency. Optimize the layout and location of HVAC equipment to keep duct runs as short and direct as feasible.

6. Balancing and Adjusting Dampers: Balancing the airflow within the duct system ensures that each room receives the appropriate amount of conditioned air. Adjust dampers at branch points and in individual ducts to balance the airflow and avoid over-pressurizing or under-pressurizing certain areas.

7. Regular Maintenance: Conduct regular inspections of the ductwork to check for leaks, obstructions, or damage. Clean the ducts periodically to remove dust, debris, or any substances that could impede airflow.

8. Air Filters: Install high-quality air filters and regularly replace them according to the manufacturer’s recommendations. Clean air filters help maintain optimal airflow, reducing pressure drops and energy losses.

By implementing these measures, you can significantly minimize energy losses in ducts, improve the overall efficiency of your HVAC system, and reduce energy consumption. Consulting with a professional HVAC contractor or engineer can provide valuable insights specific to your building’s requirements and help optimize energy efficiency.

https://homereadyinspections.com/builders-hvac/

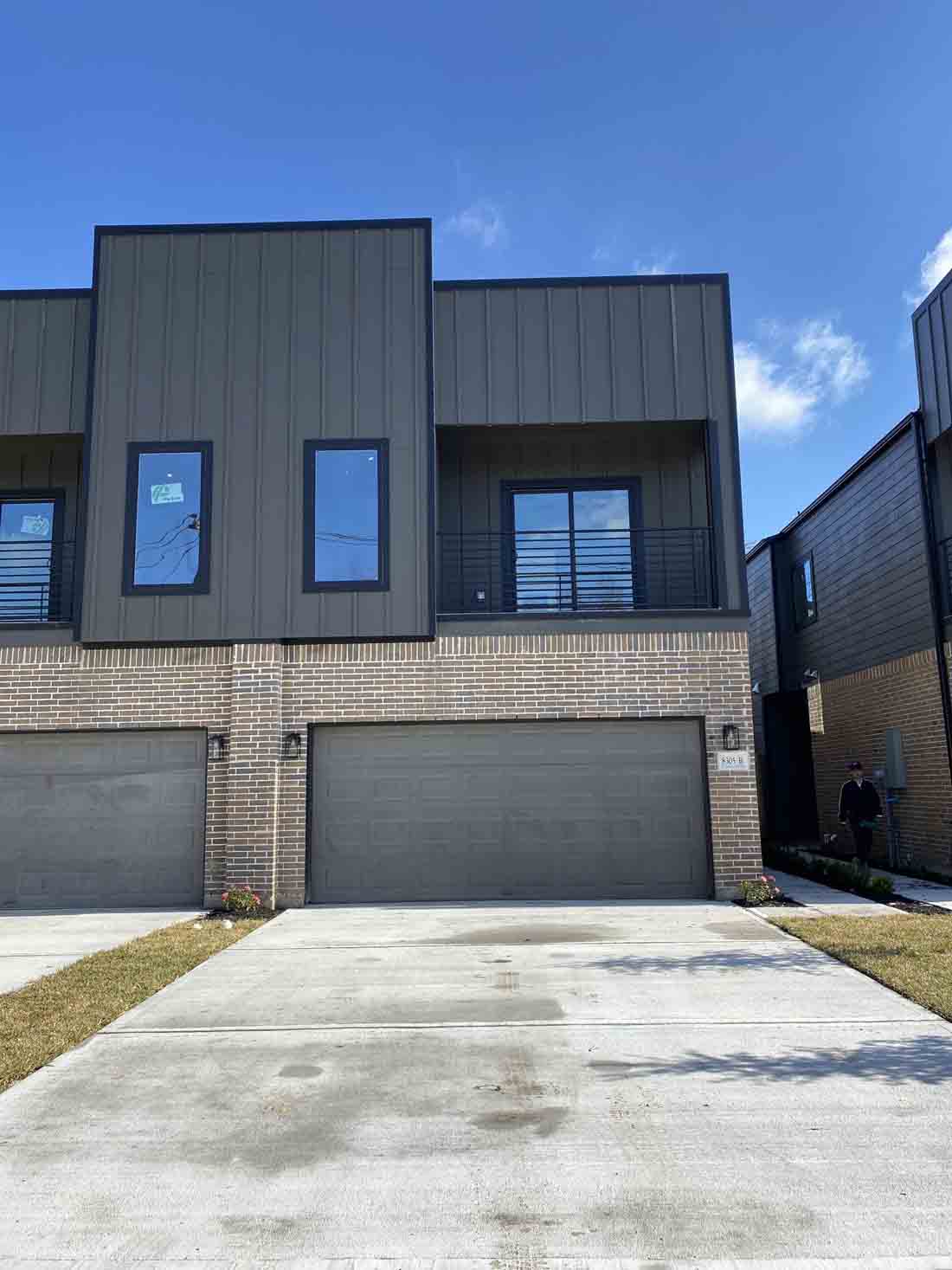

Energy Star – 45L Tax Credits for Zero Energy Ready Homes

412 Neyland St, Houston, TX 77022

45L Tax Credits for Zero Energy Ready Homes

Disclaimer: (Energy Star) This webpage provides an overview of the DOE Zero Energy Ready Home program and how it relates to the New Energy Efficient Home Tax Credit found in section 45L of the Internal Revenue Code. The information provided here does not constitute professional tax advice or other professional financial guidance. It should not be used as the only source of information when making decisions regarding design, purchasing, investments, or the tax implications of new home construction, or when executing other binding agreements. In the event that there is conflict between information provided on this webpage and guidance or notices published by IRS, the information published by IRS shall take precedence

The Updated Section 45L

The Inflation Reduction Act of 2022 (IRA) amended Internal Revenue Code Section 45L to provide taxpayers with a tax credit for eligible new or substantially reconstructed homes that meet applicable ENERGY STAR home program or DOE Zero Energy Ready Home (ZERH) program requirements. The new 45L provisions include two tiers of credits, with the higher credits for eligible homes and dwelling units certified to applicable ZERH program requirements. The 45L credit is $5,000 for single family and manufactured homes eligible to participate in the EPA’s ENERGY STAR Residential New Construction Program or the ENERGY STAR Manufactured New Homes Program, respectively, and which are certified to applicable ZERH program requirements. The 45L credit is $1,000 for dwelling units that are part of a building eligible to participate in the ENERGY STAR Multifamily New Construction Program, and which are certified to applicable ZERH program requirements, unless the project meets prevailing wage requirements, in which case the 45L credit is $5,000 per dwelling unit. These new 45L rules apply to qualified energy efficient homes acquired after December 31, 2022, and before January 1, 2033, for use as a residence during the taxable year. DOE continues to coordinate with the Internal Revenue Service (IRS) regarding forthcoming IRS 45L guidance.

DOE Zero Energy Ready Home (ZERH) Program Applicability for 45L Tax Credit, by Calendar Year

ZERH program requirements vary by housing sector. To improve the usability of the program requirements and the certification process for different sectors, DOE is developing and maintaining program requirements documents for each major housing sector. DOE anticipates updating these documents over the coming years, with new editions of the requirements referred to as versions.

The three housing sector tables below indicate DOE’s anticipated version release schedule for the ZERH program. The certification requirements for each housing sector are included below with links to detailed requirements documents (PDF) for each program version. IRS guidance will establish when a dwelling unit needs to be certified to the version in effect for that housing sector as listed below to qualify for the ZERH provisions of 45L tax credit. The tables list all current and planned versions through 2025, by Calendar Year (January 1-December 31). In conjunction with IRS, DOE will provide additional information on any planned ZERH program changes beyond 2025 on future dates to be determined. Note, for certain future planned versions the requirements documents are still under development.

https://www.energy.gov/eere/buildings/45l-tax-credits-zero-energy-ready-homes

819 Woodcrest Dr, Houston, TX 77018 – Minimizing Energy Losses in Ducts

819 Woodcrest Dr, Houston, TX 77018 – Minimizing Energy Losses in Ducts

819 Woodcrest Dr, Houston, TX 77018

Third-party Energy Testing

Your air ducts are one of the most important systems in your home, and if the ducts are poorly sealed or insulated they are likely contributing to higher energy bills.

Blower Doors: What Are They and How Do They Work?

A blower door is a device used in energy testing to measure a building’s airtightness. It consists of a powerful fan mounted on a temporary frame that fits into a doorway or an exterior opening. During a blower door test, the fan creates a pressure difference between the inside and outside of the building. This pressure difference allows air leakage points to become apparent and measurable. The test helps identify areas of air infiltration or exfiltration, which can affect energy efficiency and indoor comfort.

The blower door test involves setting up the device, measuring the baseline pressure, and then either depressurizing or pressurizing the building using the fan. While the fan is running, the airflow rate is measured using instruments like a manometer or pressure gauge. This airflow measurement quantifies the amount of air leakage in the building. Smoke pencils or thermal imaging cameras can be used to locate specific air leakage points.

The blower door test can be conducted in both depressurization and pressurization modes, allowing for a comprehensive assessment of air leakage locations. Once the test is complete, the data is analyzed to determine the building’s airtightness and identify areas that need improvement. The results can be used to guide air sealing measures and improve energy efficiency.

Blower door tests are crucial in identifying air leakage points, reducing energy loss, improving indoor air quality, and enhancing the overall performance and comfort of a building.

Home Inspection Atascocita | Home Ready Inspections | Houston TX

778 W Tidwell Rd, Houston, TX 77091 – Minimizing Energy Losses in Ducts

778 W Tidwell Rd, Houston, TX 77091 – Minimizing Energy Losses in Ducts

778 W Tidwell Rd, Houston, TX 77091

Third-party Energy Testing

Your air ducts are one of the most important systems in your home, and if the ducts are poorly sealed or insulated they are likely contributing to higher energy bills.

Blower Doors: What Are They and How Do They Work?

A blower door is a device used in energy testing to measure a building’s airtightness. It consists of a powerful fan mounted on a temporary frame that fits into a doorway or an exterior opening. During a blower door test, the fan creates a pressure difference between the inside and outside of the building. This pressure difference allows air leakage points to become apparent and measurable. The test helps identify areas of air infiltration or exfiltration, which can affect energy efficiency and indoor comfort.

The blower door test involves setting up the device, measuring the baseline pressure, and then either depressurizing or pressurizing the building using the fan. While the fan is running, the airflow rate is measured using instruments like a manometer or pressure gauge. This airflow measurement quantifies the amount of air leakage in the building. Smoke pencils or thermal imaging cameras can be used to locate specific air leakage points.

The blower door test can be conducted in both depressurization and pressurization modes, allowing for a comprehensive assessment of air leakage locations. Once the test is complete, the data is analyzed to determine the building’s airtightness and identify areas that need improvement. The results can be used to guide air sealing measures and improve energy efficiency.

Blower door tests are crucial in identifying air leakage points, reducing energy loss, improving indoor air quality, and enhancing the overall performance and comfort of a building.

Home Inspection Atascocita | Home Ready Inspections | Houston TX

Minimizing Energy Losses in Ducts at 8134 Swiftwater Ln, Houston, TX 77075

8134 Swiftwater Ln, Houston, TX 77075

Minimizing Energy Losses in Ducts

Minimizing energy losses in ducts by seeing if the ducts are poorly sealed or insulated. That could tell you why your energy bill in high. Your air ducts are one of the most important systems in your home, and if the ducts are poorly sealed or insulated, they are likely contributing to higher energy bills.

Your home’s duct system is a branching network of tubes in the walls, floors, and ceilings; it carries the air from your home’s furnace and central air conditioner to each room. Ducts are made of sheet metal, fiberglass, or other materials.

Ducts that leak heated air into unheated spaces can add hundreds of dollars a year to your heating and cooling bills, but you can reduce that loss by sealing and insulating your ducts. Insulating ducts in unconditioned spaces is usually very cost-effective. Existing ducts may also be blocked or may require simple upgrades.

Designing and Installing New Duct Systems

In new home construction or in retrofits, proper duct system design is critical. In recent years, energy-saving designs have sought to include ducts and heating systems in the conditioned space.

Efficient and well-designed duct systems distribute air properly throughout your home without leaking to keep all rooms at a comfortable temperature. The system should provide balanced supply and return flow to maintain a neutral pressure within the house.

Even well sealed and insulated ducts will leak and lose some heat, so many new energy-efficient homes place the duct system within the conditioned space of the home. The simplest way to accomplish this is to hide the ducts in dropped ceilings and in corners of rooms. Ducts can also be located in a sealed and insulated chase extending into the attic or built into raised floors. In both of these latter cases, care must be taken during construction to prevent contractors from using the duct chases for wiring or other utilities.

In either case, actual ducts must be used — chases and floor cavities should not be used as ducts. Regardless of where they are installed, ducts should be well sealed. Although ducts can be configured in a number of ways, the “trunk and branch” and “radial” supply duct configurations are most suitable for ducts located in conditioned spaces.

Air return duct systems can be configured in two ways: each room can have a return duct that sends air back to the heating and cooling equipment or return grills can be located in central locations on each floor. For the latter case, either grills must be installed to allow air to pass out of closed rooms, or short “jumper ducts” can be installed to connect the vent in one room with the next, allowing air to flow back to the central return grilles. Door undercuts help, but they are usually not sufficient for return airflow.

You can perform a simple check for adequate return air capacity by doing the following:

- Close all exterior doors and windows

- Close all interior room doors

- Turn on the central air handler

- “Crack” interior doors one by one and observe if the door closes or further opens “on its own.” (Whether it closes or opens will depend on the direction of the air handler-driven air flow.) Rooms served by air-moved doors have restricted return air flow and need pressure relief as described above.

Maintaining and Upgrading Existing Duct Systems

Sealing your ducts to prevent leaks is even more important if the ducts are located in an unconditioned area such as an attic or vented crawlspace. If the supply ducts are leaking, heated or cooled air can be forced out of unsealed joints and lost. In addition, unconditioned air can be drawn into return ducts through unsealed joints.

Although minor duct repairs are easy to make, qualified professionals should seal and insulate ducts in unconditioned spaces to ensure the use of appropriate sealing materials.

Aside from sealing your ducts, the simplest and most effective means of maintaining your air distribution system is to ensure that furniture and other objects are not blocking the airflow through your registers, and to vacuum the registers to remove any dust buildup.

Existing duct systems often suffer from design deficiencies in the return air system, and modifications by the homeowner (or just a tendency to keep doors closed) may contribute to these problems. Any rooms with a lack of sufficient return airflow may benefit from relatively simple upgrades, such as the installation of new return-air grilles, undercutting doors for return air, or installing a jumper duct.

Some rooms may also be hard to heat and cool because of inadequate supply ducts or grilles. If this is the case, you should first examine whether the problem is the room itself: fix any problems with insulation, air leakage, or inefficient windows first. If the problem persists, you may be able to increase the size of the supply duct or add an additional duct to provide the needed airflow to the room.

Minor Duct Repair Tips for Minimizing Energy Losses in Ducts

- Check your ducts for air leaks. First, look for sections that should be joined but have separated and then look for obvious holes.

- Duct mastic is the preferred material for sealing ductwork seams and joints. It is more durable than any available tape and generally easier for a do-it-yourself installation. Its only drawback is that it will not bridge gaps over ¼ inch. Such gaps must be first bridged with web-type drywall tape, or a good quality heat approved tape.

- If you use tape to seal your ducts, avoid cloth-backed, rubber adhesive duct tape — it tends to fail quickly. Instead, use mastic, butyl tape, foil tape, or other heat-approved tapes. Look for tape with the Underwriters Laboratories (UL) logo.

- Remember that insulating ducts in the basement will make the basement colder. If both the ducts and the basement walls are not insulated, consider insulating both. Water pipes and drains in unconditioned spaces could freeze and burst if the heat ducts are fully insulated because there would be no heat source to prevent the space from freezing in cold weather. However, using an electric heating tape wrap on the pipes can prevent this. Check with a professional contractor.

- Hire a professional to install both supply and return registers in the basement rooms after converting your basement to a living area.

- Be sure a well-sealed vapor barrier exists on the outside of the insulation on cooling ducts to prevent moisture condensation.

- If you have a fuel-burning furnace, stove, or other appliance or an attached garage, install a carbon monoxide (CO) monitor to alert you to harmful CO levels.

- Be sure to get professional help when doing ductwork. A qualified professional should always perform changes and repairs to a duct system.

Minimizing Energy Losses in Ducts at 9835 Tiltree St, Houston, TX 77075

9835 Tiltree St, Houston, TX 77075

Minimizing Energy Losses in Ducts

Minimizing energy losses in ducts by seeing if the ducts are poorly sealed or insulated. That could tell you why your energy bill in high. Your air ducts are one of the most important systems in your home, and if the ducts are poorly sealed or insulated, they are likely contributing to higher energy bills.

Your home’s duct system is a branching network of tubes in the walls, floors, and ceilings; it carries the air from your home’s furnace and central air conditioner to each room. Ducts are made of sheet metal, fiberglass, or other materials.

Ducts that leak heated air into unheated spaces can add hundreds of dollars a year to your heating and cooling bills, but you can reduce that loss by sealing and insulating your ducts. Insulating ducts in unconditioned spaces is usually very cost-effective. Existing ducts may also be blocked or may require simple upgrades.

Designing and Installing New Duct Systems

In new home construction or in retrofits, proper duct system design is critical. In recent years, energy-saving designs have sought to include ducts and heating systems in the conditioned space.

Efficient and well-designed duct systems distribute air properly throughout your home without leaking to keep all rooms at a comfortable temperature. The system should provide balanced supply and return flow to maintain a neutral pressure within the house.

Even well sealed and insulated ducts will leak and lose some heat, so many new energy-efficient homes place the duct system within the conditioned space of the home. The simplest way to accomplish this is to hide the ducts in dropped ceilings and in corners of rooms. Ducts can also be located in a sealed and insulated chase extending into the attic or built into raised floors. In both of these latter cases, care must be taken during construction to prevent contractors from using the duct chases for wiring or other utilities.

In either case, actual ducts must be used — chases and floor cavities should not be used as ducts. Regardless of where they are installed, ducts should be well sealed. Although ducts can be configured in a number of ways, the “trunk and branch” and “radial” supply duct configurations are most suitable for ducts located in conditioned spaces.

Air return duct systems can be configured in two ways: each room can have a return duct that sends air back to the heating and cooling equipment or return grills can be located in central locations on each floor. For the latter case, either grills must be installed to allow air to pass out of closed rooms, or short “jumper ducts” can be installed to connect the vent in one room with the next, allowing air to flow back to the central return grilles. Door undercuts help, but they are usually not sufficient for return airflow.

You can perform a simple check for adequate return air capacity by doing the following:

- Close all exterior doors and windows

- Close all interior room doors

- Turn on the central air handler

- “Crack” interior doors one by one and observe if the door closes or further opens “on its own.” (Whether it closes or opens will depend on the direction of the air handler-driven air flow.) Rooms served by air-moved doors have restricted return air flow and need pressure relief as described above.

Maintaining and Upgrading Existing Duct Systems

Sealing your ducts to prevent leaks is even more important if the ducts are located in an unconditioned area such as an attic or vented crawlspace. If the supply ducts are leaking, heated or cooled air can be forced out of unsealed joints and lost. In addition, unconditioned air can be drawn into return ducts through unsealed joints.

Although minor duct repairs are easy to make, qualified professionals should seal and insulate ducts in unconditioned spaces to ensure the use of appropriate sealing materials.

Aside from sealing your ducts, the simplest and most effective means of maintaining your air distribution system is to ensure that furniture and other objects are not blocking the airflow through your registers, and to vacuum the registers to remove any dust buildup.

Existing duct systems often suffer from design deficiencies in the return air system, and modifications by the homeowner (or just a tendency to keep doors closed) may contribute to these problems. Any rooms with a lack of sufficient return airflow may benefit from relatively simple upgrades, such as the installation of new return-air grilles, undercutting doors for return air, or installing a jumper duct.

Some rooms may also be hard to heat and cool because of inadequate supply ducts or grilles. If this is the case, you should first examine whether the problem is the room itself: fix any problems with insulation, air leakage, or inefficient windows first. If the problem persists, you may be able to increase the size of the supply duct or add an additional duct to provide the needed airflow to the room.

Minor Duct Repair Tips for Minimizing Energy Losses in Ducts

- Check your ducts for air leaks. First, look for sections that should be joined but have separated and then look for obvious holes.

- Duct mastic is the preferred material for sealing ductwork seams and joints. It is more durable than any available tape and generally easier for a do-it-yourself installation. Its only drawback is that it will not bridge gaps over ¼ inch. Such gaps must be first bridged with web-type drywall tape, or a good quality heat approved tape.

- If you use tape to seal your ducts, avoid cloth-backed, rubber adhesive duct tape — it tends to fail quickly. Instead, use mastic, butyl tape, foil tape, or other heat-approved tapes. Look for tape with the Underwriters Laboratories (UL) logo.

- Remember that insulating ducts in the basement will make the basement colder. If both the ducts and the basement walls are not insulated, consider insulating both. Water pipes and drains in unconditioned spaces could freeze and burst if the heat ducts are fully insulated because there would be no heat source to prevent the space from freezing in cold weather. However, using an electric heating tape wrap on the pipes can prevent this. Check with a professional contractor.

- Hire a professional to install both supply and return registers in the basement rooms after converting your basement to a living area.

- Be sure a well-sealed vapor barrier exists on the outside of the insulation on cooling ducts to prevent moisture condensation.

- If you have a fuel-burning furnace, stove, or other appliance or an attached garage, install a carbon monoxide (CO) monitor to alert you to harmful CO levels.

- Be sure to get professional help when doing ductwork. A qualified professional should always perform changes and repairs to a duct system.

Minimizing Energy Losses in Ducts at 25947 Bay Breeze Dr, Galveston, TX 77554

25947 Bay Breeze Dr, Galveston, TX 77554

Minimizing Energy Losses in Ducts

Minimizing energy losses in ducts by seeing if the ducts are poorly sealed or insulated. That could tell you why your energy bill in high. Your air ducts are one of the most important systems in your home, and if the ducts are poorly sealed or insulated, they are likely contributing to higher energy bills.

Your home’s duct system is a branching network of tubes in the walls, floors, and ceilings; it carries the air from your home’s furnace and central air conditioner to each room. Ducts are made of sheet metal, fiberglass, or other materials.

Ducts that leak heated air into unheated spaces can add hundreds of dollars a year to your heating and cooling bills, but you can reduce that loss by sealing and insulating your ducts. Insulating ducts in unconditioned spaces is usually very cost-effective. Existing ducts may also be blocked or may require simple upgrades.

Designing and Installing New Duct Systems

In new home construction or in retrofits, proper duct system design is critical. In recent years, energy-saving designs have sought to include ducts and heating systems in the conditioned space.

Efficient and well-designed duct systems distribute air properly throughout your home without leaking to keep all rooms at a comfortable temperature. The system should provide balanced supply and return flow to maintain a neutral pressure within the house.

Even well sealed and insulated ducts will leak and lose some heat, so many new energy-efficient homes place the duct system within the conditioned space of the home. The simplest way to accomplish this is to hide the ducts in dropped ceilings and in corners of rooms. Ducts can also be located in a sealed and insulated chase extending into the attic or built into raised floors. In both of these latter cases, care must be taken during construction to prevent contractors from using the duct chases for wiring or other utilities.

In either case, actual ducts must be used — chases and floor cavities should not be used as ducts. Regardless of where they are installed, ducts should be well sealed. Although ducts can be configured in a number of ways, the “trunk and branch” and “radial” supply duct configurations are most suitable for ducts located in conditioned spaces.

Air return duct systems can be configured in two ways: each room can have a return duct that sends air back to the heating and cooling equipment or return grills can be located in central locations on each floor. For the latter case, either grills must be installed to allow air to pass out of closed rooms, or short “jumper ducts” can be installed to connect the vent in one room with the next, allowing air to flow back to the central return grilles. Door undercuts help, but they are usually not sufficient for return airflow.

You can perform a simple check for adequate return air capacity by doing the following:

- Close all exterior doors and windows

- Close all interior room doors

- Turn on the central air handler

- “Crack” interior doors one by one and observe if the door closes or further opens “on its own.” (Whether it closes or opens will depend on the direction of the air handler-driven air flow.) Rooms served by air-moved doors have restricted return air flow and need pressure relief as described above.

Maintaining and Upgrading Existing Duct Systems

Sealing your ducts to prevent leaks is even more important if the ducts are located in an unconditioned area such as an attic or vented crawlspace. If the supply ducts are leaking, heated or cooled air can be forced out of unsealed joints and lost. In addition, unconditioned air can be drawn into return ducts through unsealed joints.

Although minor duct repairs are easy to make, qualified professionals should seal and insulate ducts in unconditioned spaces to ensure the use of appropriate sealing materials.

Aside from sealing your ducts, the simplest and most effective means of maintaining your air distribution system is to ensure that furniture and other objects are not blocking the airflow through your registers, and to vacuum the registers to remove any dust buildup.

Existing duct systems often suffer from design deficiencies in the return air system, and modifications by the homeowner (or just a tendency to keep doors closed) may contribute to these problems. Any rooms with a lack of sufficient return airflow may benefit from relatively simple upgrades, such as the installation of new return-air grilles, undercutting doors for return air, or installing a jumper duct.

Some rooms may also be hard to heat and cool because of inadequate supply ducts or grilles. If this is the case, you should first examine whether the problem is the room itself: fix any problems with insulation, air leakage, or inefficient windows first. If the problem persists, you may be able to increase the size of the supply duct or add an additional duct to provide the needed airflow to the room.

Minor Duct Repair Tips for Minimizing Energy Losses in Ducts

- Check your ducts for air leaks. First, look for sections that should be joined but have separated and then look for obvious holes.

- Duct mastic is the preferred material for sealing ductwork seams and joints. It is more durable than any available tape and generally easier for a do-it-yourself installation. Its only drawback is that it will not bridge gaps over ¼ inch. Such gaps must be first bridged with web-type drywall tape, or a good quality heat approved tape.

- If you use tape to seal your ducts, avoid cloth-backed, rubber adhesive duct tape — it tends to fail quickly. Instead, use mastic, butyl tape, foil tape, or other heat-approved tapes. Look for tape with the Underwriters Laboratories (UL) logo.

- Remember that insulating ducts in the basement will make the basement colder. If both the ducts and the basement walls are not insulated, consider insulating both. Water pipes and drains in unconditioned spaces could freeze and burst if the heat ducts are fully insulated because there would be no heat source to prevent the space from freezing in cold weather. However, using an electric heating tape wrap on the pipes can prevent this. Check with a professional contractor.

- Hire a professional to install both supply and return registers in the basement rooms after converting your basement to a living area.

- Be sure a well-sealed vapor barrier exists on the outside of the insulation on cooling ducts to prevent moisture condensation.

- If you have a fuel-burning furnace, stove, or other appliance or an attached garage, install a carbon monoxide (CO) monitor to alert you to harmful CO levels.

- Be sure to get professional help when doing ductwork. A qualified professional should always perform changes and repairs to a duct system.

11514 Courtshire Dr, Houston, TX 77076 – Minimizing Energy Losses in Ducts

11514 Courtshire Dr, Houston, TX 77076

Minimizing Energy Losses in Ducts

Minimizing energy losses in ducts is an important aspect of energy efficiency in HVAC (Heating, Ventilation, and Air Conditioning) systems. Ducts are used to distribute conditioned air throughout a building, and any energy losses during the distribution process can lead to increased energy consumption and reduced system performance. Here are some key measures to minimize energy losses in ducts:

1. Proper Duct Design: Ensure that ductwork is properly designed to minimize pressure losses. Use appropriately sized ducts, minimize the number of bends and transitions, and maintain a balanced airflow distribution. Consult industry guidelines or work with an HVAC professional to design an efficient duct system.

2. Sealing: Duct leakage is a major source of energy losses. Seal all joints, connections, and seams in the ductwork using approved sealing materials such as mastic or metal tape. Pay particular attention to connections at registers, grilles, and air-handling units.

3. Insulation: Insulate ducts that run through unconditioned spaces, such as attics, crawlspaces, or basements. Insulation helps to prevent heat transfer between the ductwork and the surrounding environment, reducing energy losses and improving system efficiency.

4. Duct Material: Consider using insulated ducts with low thermal conductivity. Insulated ducts minimize heat transfer through the duct walls, helping to maintain the desired temperature of the conditioned air as it travels through the system.

5. Avoiding Overlong Duct Runs: Minimize the length of duct runs as much as possible. Longer ducts result in increased friction losses, which can reduce airflow and energy efficiency. Optimize the layout and location of HVAC equipment to keep duct runs as short and direct as feasible.

6. Balancing and Adjusting Dampers: Balancing the airflow within the duct system ensures that each room receives the appropriate amount of conditioned air. Adjust dampers at branch points and in individual ducts to balance the airflow and avoid over-pressurizing or under-pressurizing certain areas.

7. Regular Maintenance: Conduct regular inspections of the ductwork to check for leaks, obstructions, or damage. Clean the ducts periodically to remove dust, debris, or any substances that could impede airflow.

8. Air Filters: Install high-quality air filters and regularly replace them according to the manufacturer’s recommendations. Clean air filters help maintain optimal airflow, reducing pressure drops and energy losses.

By implementing these measures, you can significantly minimize energy losses in ducts, improve the overall efficiency of your HVAC system, and reduce energy consumption. Consulting with a professional HVAC contractor or engineer can provide valuable insights specific to your building’s requirements and help optimize energy efficiency.

https://homereadyinspections.com/builders-hvac/

2121 Naomi St, Houston, TX 77051 – Minimizing Energy Losses in Ducts

Minimizing Energy Losses in Ducts

Minimizing Energy Losses in Ducts

Minimizing energy losses in ducts is an important aspect of energy efficiency in HVAC (Heating, Ventilation, and Air Conditioning) systems. Ducts are used to distribute conditioned air throughout a building, and any energy losses during the distribution process can lead to increased energy consumption and reduced system performance. Here are some key measures to minimize energy losses in ducts:

1. Proper Duct Design: Ensure that ductwork is properly designed to minimize pressure losses. Use appropriately sized ducts, minimize the number of bends and transitions, and maintain a balanced airflow distribution. Consult industry guidelines or work with an HVAC professional to design an efficient duct system.

2. Sealing: Duct leakage is a major source of energy losses. Seal all joints, connections, and seams in the ductwork using approved sealing materials such as mastic or metal tape. Pay particular attention to connections at registers, grilles, and air-handling units.

3. Insulation: Insulate ducts that run through unconditioned spaces, such as attics, crawlspaces, or basements. Insulation helps to prevent heat transfer between the ductwork and the surrounding environment, reducing energy losses and improving system efficiency.

4. Duct Material: Consider using insulated ducts with low thermal conductivity. Insulated ducts minimize heat transfer through the duct walls, helping to maintain the desired temperature of the conditioned air as it travels through the system.

5. Avoiding Overlong Duct Runs: Minimize the length of duct runs as much as possible. Longer ducts result in increased friction losses, which can reduce airflow and energy efficiency. Optimize the layout and location of HVAC equipment to keep duct runs as short and direct as feasible.

6. Balancing and Adjusting Dampers: Balancing the airflow within the duct system ensures that each room receives the appropriate amount of conditioned air. Adjust dampers at branch points and in individual ducts to balance the airflow and avoid over-pressurizing or under-pressurizing certain areas.

7. Regular Maintenance: Conduct regular inspections of the ductwork to check for leaks, obstructions, or damage. Clean the ducts periodically to remove dust, debris, or any substances that could impede airflow.

8. Air Filters: Install high-quality air filters and regularly replace them according to the manufacturer’s recommendations. Clean air filters help maintain optimal airflow, reducing pressure drops and energy losses.

By implementing these measures, you can significantly minimize energy losses in ducts, improve the overall efficiency of your HVAC system, and reduce energy consumption. Consulting with a professional HVAC contractor or engineer can provide valuable insights specific to your building’s requirements and help optimize energy efficiency.

https://homereadyinspections.com/builders-hvac/

4325 Phlox St Unit A, Houston TX 77051 Minimizing Energy Losses in Ducts

4325 Phlox St Unit A, Houston TX 77051

Minimizing Energy Losses in Ducts

Minimizing energy losses in ducts is an important aspect of energy efficiency in HVAC (Heating, Ventilation, and Air Conditioning) systems. Ducts are used to distribute conditioned air throughout a building, and any energy losses during the distribution process can lead to increased energy consumption and reduced system performance. Here are some key measures to minimize energy losses in ducts:

1. Proper Duct Design: Ensure that ductwork is properly designed to minimize pressure losses. Use appropriately sized ducts, minimize the number of bends and transitions, and maintain a balanced airflow distribution. Consult industry guidelines or work with an HVAC professional to design an efficient duct system.

2. Sealing: Duct leakage is a major source of energy losses. Seal all joints, connections, and seams in the ductwork using approved sealing materials such as mastic or metal tape. Pay particular attention to connections at registers, grilles, and air-handling units.

3. Insulation: Insulate ducts that run through unconditioned spaces, such as attics, crawlspaces, or basements. Insulation helps to prevent heat transfer between the ductwork and the surrounding environment, reducing energy losses and improving system efficiency.

4. Duct Material: Consider using insulated ducts with low thermal conductivity. Insulated ducts minimize heat transfer through the duct walls, helping to maintain the desired temperature of the conditioned air as it travels through the system.

5. Avoiding Overlong Duct Runs: Minimize the length of duct runs as much as possible. Longer ducts result in increased friction losses, which can reduce airflow and energy efficiency. Optimize the layout and location of HVAC equipment to keep duct runs as short and direct as feasible.

6. Balancing and Adjusting Dampers: Balancing the airflow within the duct system ensures that each room receives the appropriate amount of conditioned air. Adjust dampers at branch points and in individual ducts to balance the airflow and avoid over-pressurizing or under-pressurizing certain areas.

7. Regular Maintenance: Conduct regular inspections of the ductwork to check for leaks, obstructions, or damage. Clean the ducts periodically to remove dust, debris, or any substances that could impede airflow.

8. Air Filters: Install high-quality air filters and regularly replace them according to the manufacturer’s recommendations. Clean air filters help maintain optimal airflow, reducing pressure drops and energy losses.

By implementing these measures, you can significantly minimize energy losses in ducts, improve the overall efficiency of your HVAC system, and reduce energy consumption. Consulting with a professional HVAC contractor or engineer can provide valuable insights specific to your building’s requirements and help optimize energy efficiency.

https://homereadyinspections.com/builders-hvac/

5743 Lycomb Dr, Houston, TX 77053 – Minimizing Energy Losses in Ducts

5743 Lycomb Dr, Houston, TX 77053 – Minimizing Energy Losses in Ducts

5743 Lycomb Dr, Houston, TX 77053

Third-party Energy Testing

Your air ducts are one of the most important systems in your home, and if the ducts are poorly sealed or insulated they are likely contributing to higher energy bills.

Blower Doors: What Are They and How Do They Work?

A blower door is a device used in energy testing to measure a building’s airtightness. It consists of a powerful fan mounted on a temporary frame that fits into a doorway or an exterior opening. During a blower door test, the fan creates a pressure difference between the inside and outside of the building. This pressure difference allows air leakage points to become apparent and measurable. The test helps identify areas of air infiltration or exfiltration, which can affect energy efficiency and indoor comfort.

The blower door test involves setting up the device, measuring the baseline pressure, and then either depressurizing or pressurizing the building using the fan. While the fan is running, the airflow rate is measured using instruments like a manometer or pressure gauge. This airflow measurement quantifies the amount of air leakage in the building. Smoke pencils or thermal imaging cameras can be used to locate specific air leakage points.

The blower door test can be conducted in both depressurization and pressurization modes, allowing for a comprehensive assessment of air leakage locations. Once the test is complete, the data is analyzed to determine the building’s airtightness and identify areas that need improvement. The results can be used to guide air sealing measures and improve energy efficiency.

Blower door tests are crucial in identifying air leakage points, reducing energy loss, improving indoor air quality, and enhancing the overall performance and comfort of a building.

Home Inspection Atascocita | Home Ready Inspections | Houston TX

4703 Park Dr, Houston, TX 77023 – Minimizing Energy Losses in Duct

4703 Park Dr, Houston, TX 77023

Houston, TX, 77023 – Minimizing Energy Losses in Duct

Third-party Energy Testing

Your air ducts are one of the most important systems in your home, and if the ducts are poorly sealed or insulated they are likely contributing to higher energy bills.

Blower Doors: What Are They and How Do They Work?

A blower door is a device used in energy testing to measure a building’s airtightness. It consists of a powerful fan mounted on a temporary frame that fits into a doorway or an exterior opening. During a blower door test, the fan creates a pressure difference between the inside and outside of the building. This pressure difference allows air leakage points to become apparent and measurable. The test helps identify areas of air infiltration or exfiltration, which can affect energy efficiency and indoor comfort.

The blower door test involves setting up the device, measuring the baseline pressure, and then either depressurizing or pressurizing the building using the fan. While the fan is running, the airflow rate is measured using instruments like a manometer or pressure gauge. This airflow measurement quantifies the amount of air leakage in the building. Smoke pencils or thermal imaging cameras can be used to locate specific air leakage points.

The blower door test can be conducted in both depressurization and pressurization modes, allowing for a comprehensive assessment of air leakage locations. Once the test is complete, the data is analyzed to determine the building’s airtightness and identify areas that need improvement. The results can be used to guide air sealing measures and improve energy efficiency.

Blower door tests are crucial in identifying air leakage points, reducing energy loss, improving indoor air quality, and enhancing the overall performance and comfort of a building.

Home Inspection Atascocita | Home Ready Inspections | Houston TX

Energy Star – 45L Tax Credits for Zero Energy Ready Homes

1113 Amundsen St, Houston, TX 77009

45L Tax Credits for Zero Energy Ready Homes

Disclaimer: (Energy Star) This webpage provides an overview of the DOE Zero Energy Ready Home program and how it relates to the New Energy Efficient Home Tax Credit found in section 45L of the Internal Revenue Code. The information provided here does not constitute professional tax advice or other professional financial guidance. It should not be used as the only source of information when making decisions regarding design, purchasing, investments, or the tax implications of new home construction, or when executing other binding agreements. In the event that there is conflict between information provided on this webpage and guidance or notices published by IRS, the information published by IRS shall take precedence

The Updated Section 45L

The Inflation Reduction Act of 2022 (IRA) amended Internal Revenue Code Section 45L to provide taxpayers with a tax credit for eligible new or substantially reconstructed homes that meet applicable ENERGY STAR home program or DOE Zero Energy Ready Home (ZERH) program requirements. The new 45L provisions include two tiers of credits, with the higher credits for eligible homes and dwelling units certified to applicable ZERH program requirements. The 45L credit is $5,000 for single family and manufactured homes eligible to participate in the EPA’s ENERGY STAR Residential New Construction Program or the ENERGY STAR Manufactured New Homes Program, respectively, and which are certified to applicable ZERH program requirements. The 45L credit is $1,000 for dwelling units that are part of a building eligible to participate in the ENERGY STAR Multifamily New Construction Program, and which are certified to applicable ZERH program requirements, unless the project meets prevailing wage requirements, in which case the 45L credit is $5,000 per dwelling unit. These new 45L rules apply to qualified energy efficient homes acquired after December 31, 2022, and before January 1, 2033, for use as a residence during the taxable year. DOE continues to coordinate with the Internal Revenue Service (IRS) regarding forthcoming IRS 45L guidance.

DOE Zero Energy Ready Home (ZERH) Program Applicability for 45L Tax Credit, by Calendar Year

ZERH program requirements vary by housing sector. To improve the usability of the program requirements and the certification process for different sectors, DOE is developing and maintaining program requirements documents for each major housing sector. DOE anticipates updating these documents over the coming years, with new editions of the requirements referred to as versions.

The three housing sector tables below indicate DOE’s anticipated version release schedule for the ZERH program. The certification requirements for each housing sector are included below with links to detailed requirements documents (PDF) for each program version. IRS guidance will establish when a dwelling unit needs to be certified to the version in effect for that housing sector as listed below to qualify for the ZERH provisions of 45L tax credit. The tables list all current and planned versions through 2025, by Calendar Year (January 1-December 31). In conjunction with IRS, DOE will provide additional information on any planned ZERH program changes beyond 2025 on future dates to be determined. Note, for certain future planned versions the requirements documents are still under development.

https://www.energy.gov/eere/buildings/45l-tax-credits-zero-energy-ready-homes

Minimizing Energy Losses in Ducts at 1314 Chestnut Ridge Rd, Kingwood, TX 77339

1314 Chestnut Ridge Rd, Kingwood, TX 77339

Minimizing Energy Losses in Ducts

Minimizing energy losses in ducts by seeing if the ducts are poorly sealed or insulated. That could tell you why your energy bill in high. Your air ducts are one of the most important systems in your home, and if the ducts are poorly sealed or insulated, they are likely contributing to higher energy bills.

Your home’s duct system is a branching network of tubes in the walls, floors, and ceilings; it carries the air from your home’s furnace and central air conditioner to each room. Ducts are made of sheet metal, fiberglass, or other materials.

Ducts that leak heated air into unheated spaces can add hundreds of dollars a year to your heating and cooling bills, but you can reduce that loss by sealing and insulating your ducts. Insulating ducts in unconditioned spaces is usually very cost-effective. Existing ducts may also be blocked or may require simple upgrades.

Designing and Installing New Duct Systems

In new home construction or in retrofits, proper duct system design is critical. In recent years, energy-saving designs have sought to include ducts and heating systems in the conditioned space.

Efficient and well-designed duct systems distribute air properly throughout your home without leaking to keep all rooms at a comfortable temperature. The system should provide balanced supply and return flow to maintain a neutral pressure within the house.

Even well sealed and insulated ducts will leak and lose some heat, so many new energy-efficient homes place the duct system within the conditioned space of the home. The simplest way to accomplish this is to hide the ducts in dropped ceilings and in corners of rooms. Ducts can also be located in a sealed and insulated chase extending into the attic or built into raised floors. In both of these latter cases, care must be taken during construction to prevent contractors from using the duct chases for wiring or other utilities.

In either case, actual ducts must be used — chases and floor cavities should not be used as ducts. Regardless of where they are installed, ducts should be well sealed. Although ducts can be configured in a number of ways, the “trunk and branch” and “radial” supply duct configurations are most suitable for ducts located in conditioned spaces.

Air return duct systems can be configured in two ways: each room can have a return duct that sends air back to the heating and cooling equipment or return grills can be located in central locations on each floor. For the latter case, either grills must be installed to allow air to pass out of closed rooms, or short “jumper ducts” can be installed to connect the vent in one room with the next, allowing air to flow back to the central return grilles. Door undercuts help, but they are usually not sufficient for return airflow.

You can perform a simple check for adequate return air capacity by doing the following:

- Close all exterior doors and windows

- Close all interior room doors

- Turn on the central air handler

- “Crack” interior doors one by one and observe if the door closes or further opens “on its own.” (Whether it closes or opens will depend on the direction of the air handler-driven air flow.) Rooms served by air-moved doors have restricted return air flow and need pressure relief as described above.

Maintaining and Upgrading Existing Duct Systems

Sealing your ducts to prevent leaks is even more important if the ducts are located in an unconditioned area such as an attic or vented crawlspace. If the supply ducts are leaking, heated or cooled air can be forced out of unsealed joints and lost. In addition, unconditioned air can be drawn into return ducts through unsealed joints.

Although minor duct repairs are easy to make, qualified professionals should seal and insulate ducts in unconditioned spaces to ensure the use of appropriate sealing materials.

Aside from sealing your ducts, the simplest and most effective means of maintaining your air distribution system is to ensure that furniture and other objects are not blocking the airflow through your registers, and to vacuum the registers to remove any dust buildup.

Existing duct systems often suffer from design deficiencies in the return air system, and modifications by the homeowner (or just a tendency to keep doors closed) may contribute to these problems. Any rooms with a lack of sufficient return airflow may benefit from relatively simple upgrades, such as the installation of new return-air grilles, undercutting doors for return air, or installing a jumper duct.

Some rooms may also be hard to heat and cool because of inadequate supply ducts or grilles. If this is the case, you should first examine whether the problem is the room itself: fix any problems with insulation, air leakage, or inefficient windows first. If the problem persists, you may be able to increase the size of the supply duct or add an additional duct to provide the needed airflow to the room.

Minor Duct Repair Tips for Minimizing Energy Losses in Ducts

- Check your ducts for air leaks. First, look for sections that should be joined but have separated and then look for obvious holes.

- Duct mastic is the preferred material for sealing ductwork seams and joints. It is more durable than any available tape and generally easier for a do-it-yourself installation. Its only drawback is that it will not bridge gaps over ¼ inch. Such gaps must be first bridged with web-type drywall tape, or a good quality heat approved tape.

- If you use tape to seal your ducts, avoid cloth-backed, rubber adhesive duct tape — it tends to fail quickly. Instead, use mastic, butyl tape, foil tape, or other heat-approved tapes. Look for tape with the Underwriters Laboratories (UL) logo.

- Remember that insulating ducts in the basement will make the basement colder. If both the ducts and the basement walls are not insulated, consider insulating both. Water pipes and drains in unconditioned spaces could freeze and burst if the heat ducts are fully insulated because there would be no heat source to prevent the space from freezing in cold weather. However, using an electric heating tape wrap on the pipes can prevent this. Check with a professional contractor.

- Hire a professional to install both supply and return registers in the basement rooms after converting your basement to a living area.

- Be sure a well-sealed vapor barrier exists on the outside of the insulation on cooling ducts to prevent moisture condensation.

- If you have a fuel-burning furnace, stove, or other appliance or an attached garage, install a carbon monoxide (CO) monitor to alert you to harmful CO levels.

- Be sure to get professional help when doing ductwork. A qualified professional should always perform changes and repairs to a duct system.

Minimizing Energy Losses in Ducts at 3715 Piping Rock Ln, Houston, TX 77027

3715 Piping Rock Ln, Houston, TX 77027

Minimizing Energy Losses in Ducts

Minimizing energy losses in ducts by seeing if the ducts are poorly sealed or insulated. That could tell you why your energy bill in high. Your air ducts are one of the most important systems in your home, and if the ducts are poorly sealed or insulated, they are likely contributing to higher energy bills.

Your home’s duct system is a branching network of tubes in the walls, floors, and ceilings; it carries the air from your home’s furnace and central air conditioner to each room. Ducts are made of sheet metal, fiberglass, or other materials.

Ducts that leak heated air into unheated spaces can add hundreds of dollars a year to your heating and cooling bills, but you can reduce that loss by sealing and insulating your ducts. Insulating ducts in unconditioned spaces is usually very cost-effective. Existing ducts may also be blocked or may require simple upgrades.

Designing and Installing New Duct Systems

In new home construction or in retrofits, proper duct system design is critical. In recent years, energy-saving designs have sought to include ducts and heating systems in the conditioned space.

Efficient and well-designed duct systems distribute air properly throughout your home without leaking to keep all rooms at a comfortable temperature. The system should provide balanced supply and return flow to maintain a neutral pressure within the house.

Even well sealed and insulated ducts will leak and lose some heat, so many new energy-efficient homes place the duct system within the conditioned space of the home. The simplest way to accomplish this is to hide the ducts in dropped ceilings and in corners of rooms. Ducts can also be located in a sealed and insulated chase extending into the attic or built into raised floors. In both of these latter cases, care must be taken during construction to prevent contractors from using the duct chases for wiring or other utilities.

In either case, actual ducts must be used — chases and floor cavities should not be used as ducts. Regardless of where they are installed, ducts should be well sealed. Although ducts can be configured in a number of ways, the “trunk and branch” and “radial” supply duct configurations are most suitable for ducts located in conditioned spaces.

Air return duct systems can be configured in two ways: each room can have a return duct that sends air back to the heating and cooling equipment or return grills can be located in central locations on each floor. For the latter case, either grills must be installed to allow air to pass out of closed rooms, or short “jumper ducts” can be installed to connect the vent in one room with the next, allowing air to flow back to the central return grilles. Door undercuts help, but they are usually not sufficient for return airflow.

You can perform a simple check for adequate return air capacity by doing the following:

- Close all exterior doors and windows

- Close all interior room doors

- Turn on the central air handler